Over the weekend, we witnessed the popular protest movement Black Lives Matter spread across the Atlantic, as hundreds of thousands of people across the globe have taken up the call.

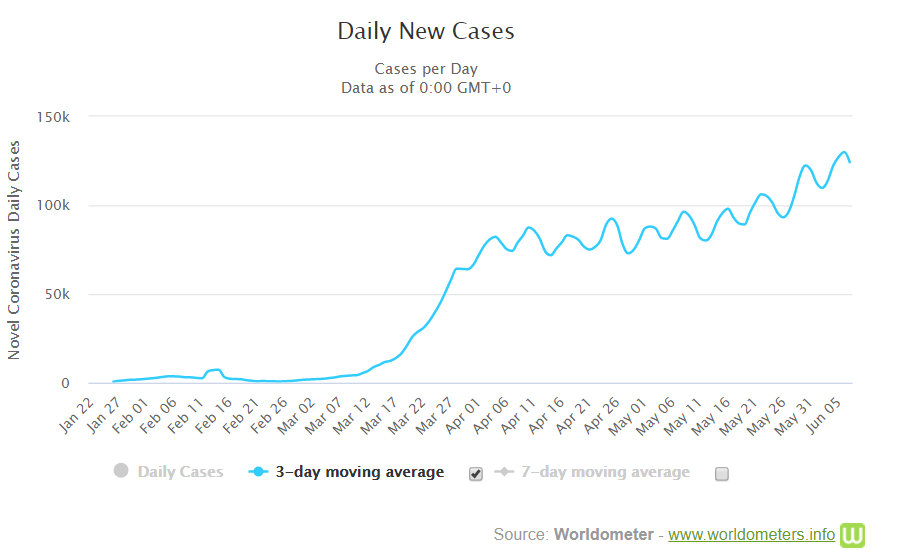

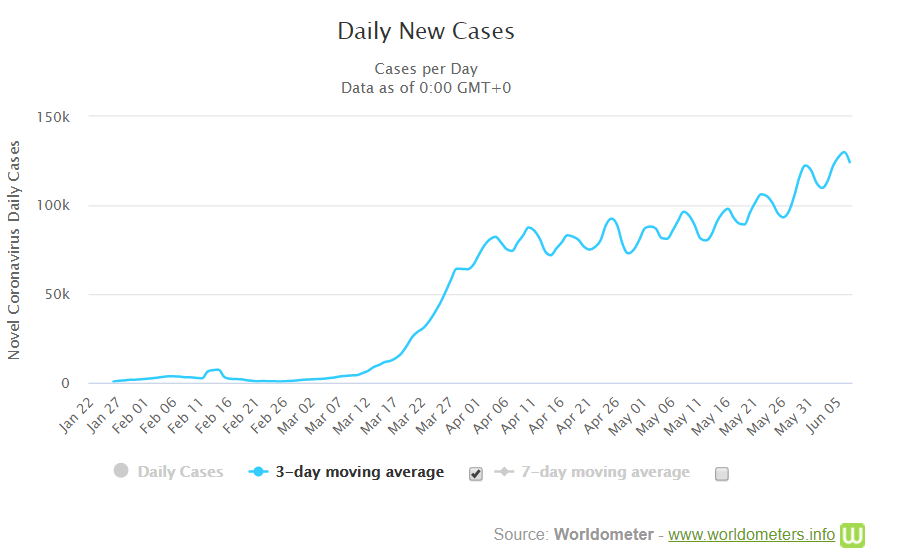

While I applaud the fact that people are waking up to racial injustice and certainly support this cause, one can’t help but wonder what impact these mass gatherings could have on the spread of COVID-19.

It seems like just yesterday, people were getting very upset about even small gatherings, but now they feel comfortable to join very large ones, even though the number of coronavirus cases continues to rise.

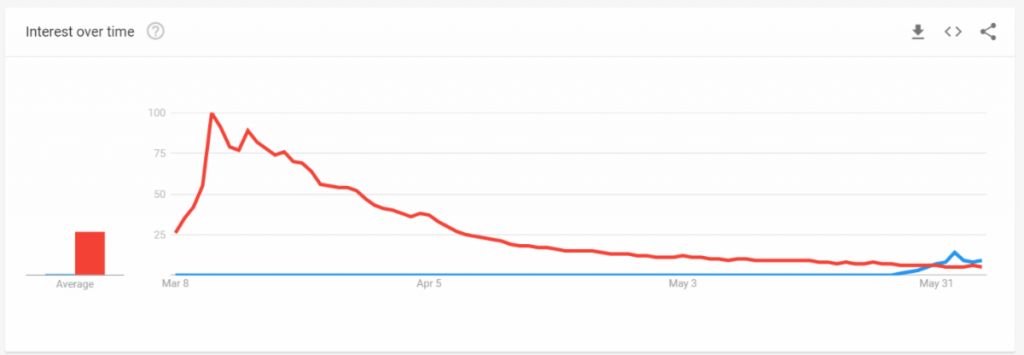

It’s quite interesting to watch the rapidly shifting narrative, which can be seen on this graph from Google Trends showing that U.S. searches for “Black Lives Matter” (in blue) have now surpassed searches for “Corona” (red).

The markets, on the other hand, should probably be showing signs of caution around both of these headwinds, but instead are blatantly disregarding all bad news as the Fed continues to pump liquidity into the system.

On Wednesday, we’ll hear from Jerome Powell of the Federal Reserve, who has managed to push the markets in the right direction, if not the economy. No doubt, he’ll cite the new case stats and possibly the rising BLM movement as reasons to continue stimulating the markets, despite them once again reaching all-time highs.

Good News is Bad

Far too often we see situations in the market where bad news is interpreted as good, but today, we’re seeing a case where good news was quite literally bad. This story has been making the rounds this morning, showing that last week’s fantastic non-farm payrolls (NFP) report was actually incorrect.

Needless to say, this revelation is a huge embarrassment for the Bureau of Labor Statistics, which produces the report. It is also a black eye for President Trump. Even though he is probably not at fault in this particular case, the president did do a fair bit of gloating on Friday.

For the markets, however, blinders are on, as investors remain laser-focused on the upcoming Fed meeting.

For myself, I just got off the phone with my broker, and have now implemented one of the biggest short positions of my career on the S&P 500, obviously while staying true to proper risk management and diversification tactics.

100 to a Penny

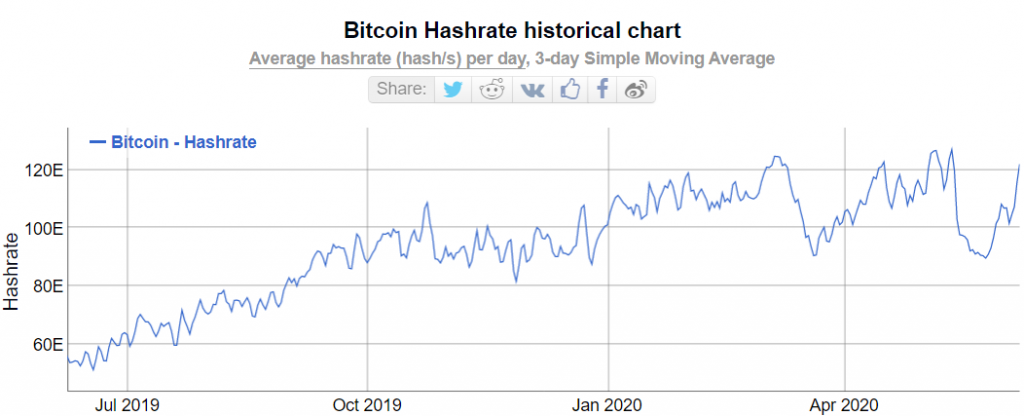

Digital assets have been remarkably stable over the last few weeks, as volumes on exchanges and on the blockchain are tapering off. Bitcoin’s hashrate, on the other hand, has already made a full recovery, as the computing power contributing to the global network is once again near record highs.

Or, if we fail to break it, resistance will likely only get stronger the next time we reach these levels. But the fact that the market refuses to move is a sign to me that this is the true value of bitcoin right now, which makes a lot of sense.

It also makes it easy to make calculations in your head. If one coin is $10,000, than 0.1 is $1,000, 0.01 is $100, and 100 sats make a penny. So, now you can see why this level is so psychologically important, and the longer we stay here, the more it will be ingrained in people’s minds.

I am a highly experienced writer and editor in the cryptocurrency field. I have written for numerous publications, including CoinDesk and Bitcoin Magazine. I am also the author of two books on cryptocurrency investing. I am passionate about blockchain technology and its potential to change the world, and I firmly believe that cryptocurrencies are here to stay forever.