Prices may be falling off the charts today, but there are clear signs that the market is not dead. Here’s a glaring example. …

There is no doubt that like many dozens of projects that are waiting more favorable market conditions before launch, Circle probably would have preferred waiting a few weeks before making such an announcement. In this case, it seems that if they don’t act quickly, the window of opportunity may close for good.

The decision to go public through a special purpose acquisition company (SPAC) rather than the traditional initial public offering (IPO) method is a page right out of Coinbase’s playbook.

The existing regulatory requirements of selling your shares to a single buyer are much more lax than issuing new shares to the general public through an underwriter.

Now that U.S. Securities and Exchange Commission Chair Gary Gensler is making it a top priority to crack down on SPACS, we can see why waiting for a better market isn’t really an option.

Still, a valuation of $4.5 billion is not bad at all for a crypto company, especially given the level of uncertainty in the market.

Circle’s place

This isn’t just any crypto company though, and the figure above is actually pretty low, at least in my mind.

Those of you who have been reading this daily newsletter for a while probably already know my thoughts on the future of central bank digital currencies (CBDCs) in the U.S.

Simply put, there probably won’t be any centralized FedCoin anytime soon. They’re way too far behind, and that’s not really how the system is set up anyway.

Most U.S. dollars are born not at the Federal Reserve or even the Treasury, but from the banks themselves. When someone takes out a loan, the bank simply clicks a few buttons and magically creates the money.

Thanks to fractional reserve banking, the bank only needs to hold a very small amount of the cash in their coffers. At the start of the pandemic, that reserve requirement was set to zero, meaning that banks could lend as much money as they wanted without holding anything in their reserves, but I digress.

This is actually very healthy for the system, because it reduces the risk of contagion. If Wells Fargo goes bankrupt, it won’t bring the entire U.S. economy down.

Rather, all dollars in circulation will be directly traceable back to their point of origin, and there can exist a small premium for dollars issued by stronger institutions.

Many existing financial institutions, however, may opt not to issue their own coin, but rather rely on a third party service that will issue the stablecoins for them.

At the moment, there is only one that is widely circulated and is compliant with all known U.S. regulations, and that’s USD coin.

In our assessment, USD coin has a fair chance of becoming the most widely used iteration of the U.S. dollar.

Measuring up

In terms of current status though, it’s not even close to the market leader tether, which basically has the lion’s share of crypto market trading.

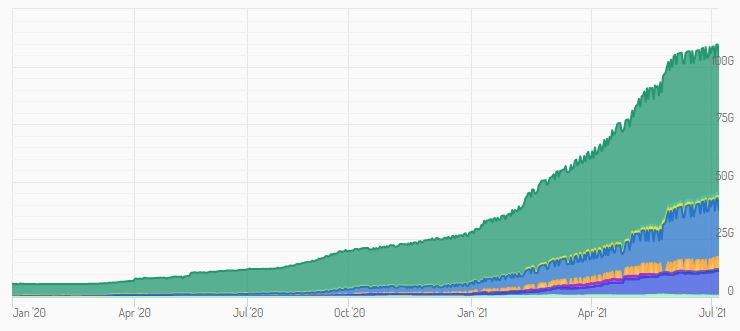

Yesterday, July 7, tether had a turnover of approximately $51 billion, whereas USD coin only facilitated $2.3 billion. If we measure by market capitalization however, which is a more accurate representation of how much money is actually being stored as stablecoins, USD coin is gaining quite quickly.

This graph shows the respective market cap of the top cryptocurrencies, where we can see that USD coin’s market share is gradually gaining as the entire industry is seeing explosive growth.

The lending rates on some of the top DeFi sites may serve as a good indicator as well. Typically, staking tether will award a slightly higher yield than USD coin.

So even though tether is more readily available and more liquid, USD coin is just seen as a more stable investment vehicle.

I am a highly experienced writer and editor in the cryptocurrency field. I have written for numerous publications, including CoinDesk and Bitcoin Magazine. I am also the author of two books on cryptocurrency investing. I am passionate about blockchain technology and its potential to change the world, and I firmly believe that cryptocurrencies are here to stay forever.