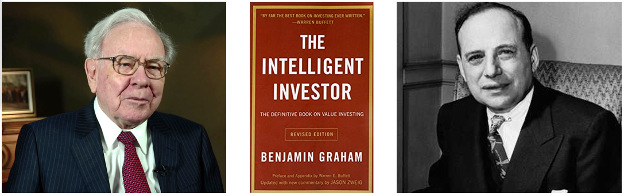

You know the guy on the left: Warren Buffett, one of the most successful investors of our time. But who’s that cat on the right?

That’s Benjamin Graham, the guy who taught Buffett how to invest.

Ben Graham’s classic book, The Intelligent Investor, is worth a read for anybody that wants to become financially independent. He outlined the principles for what is today called “Value Investing,” and much of our work here at Bitcoin Market Journal has been applying those principles to the “block market” of bitcoin, cryptocurrencies, and digital assets.

I know, I know, Warren Buffett famously hates bitcoin. We’ll change his mind.

Using the time-tested principles of value investing developed by Graham and Buffett, here’s how to value the new world of bitcoin, cryptocurrencies, and digital assets. It’s value investing for blockchains.

The Principles of Value Investing

Value investing in the traditional stock market revolves around a central concept: find great businesses at a fair price. Successful value investors follow these principles, because they work.

Think like an owner: When you buy a stock, you are literally buying a piece of a business. When you buy TSLA, you are a part-owner in the Tesla business. Is this a great business with great products, great financials, and a great management team? Would you buy 100% of the business?

Analyze rigorously: You evaluate and compare many businesses, using both quantitative (numbers) and qualitative (judgment) analysis. You say “no” to most businesses, and a big “yes” to a few super-valuable ones.

Find stocks on sale: You look for undervalued businesses, or at least you try not to overpay. Ideally you’re looking for a terrific business at a fair price (or lower).

Avoid losses: You diversify your investments, don’t put all your eggs in one basket, and avoid taking YOLO-style gambles.

Think long-term: As a value investor, you’re looking to build wealth over a lifetime. You don’t think “get rich quick” but “get rich and make it stick.”

Our big idea is these principles can also be applied to the world of blockchain investing.

In other words, we can think of blockchain projects like “businesses.”

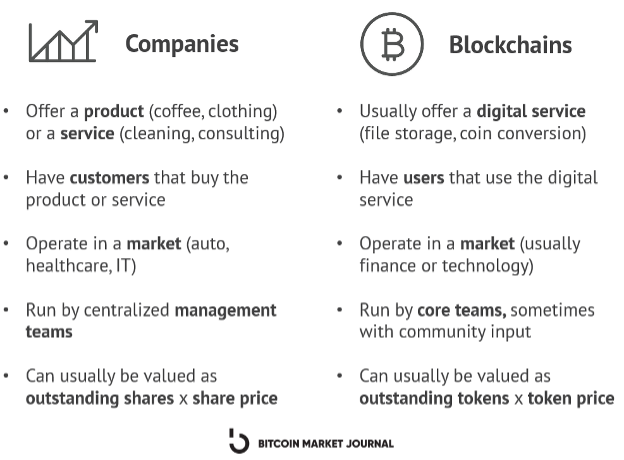

I’m going to keep “businesses” in quotes, because in most cases, blockchain projects are not businesses. Let’s highlight a few of the differences.

Blockchains are Not Businesses…

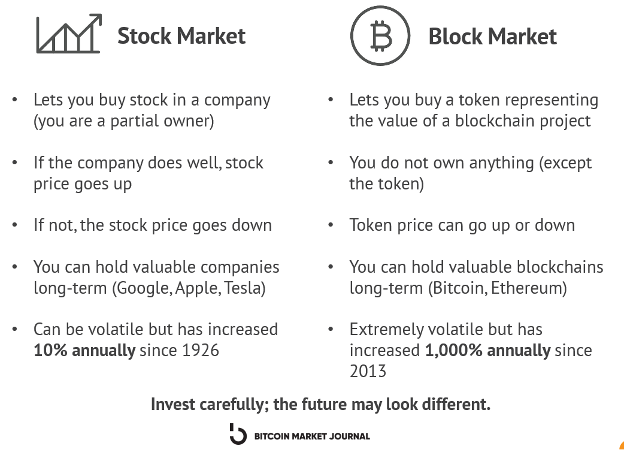

When you buy a traditional stock, you become a shareholder of the company. We call it a “share” because you now share ownership with all the other people that own that company’s stock.

Because a company is a legal entity, you now have certain legal rights as a shareholder. If the company goes bankrupt, they may distribute its remaining assets to the shareholders. If the company has excess profits, you may receive dividends. And you can vote on important decisions.

When you buy a blockchain token, on the other hand, you do not own anything except the token. The token is a claim to a portion of the value of the blockchain project. In other words, if you own 1 ETH out of 117 million total ETH, and the total value (market cap) of Ethereum is $275 billion, you can redeem (or sell) your 1 ETH for $2,350 (or $275,000,000,000 / 117,000,000).

Of course, most investors just look at the price of ETH and say, “The price is $2,350,” just like most investors look at the price of TSLA and say, “The price is $675.” We can think of the “price” of both businesses and blockchains as the “price per share,” or the total value divided by the number of shares.

Boy, is this powerful. Now we have a common framework that we can use across both traditional investing and blockchain investing. We can apply the principles of value investing – finding great businesses at a fair price – to blockchain.

Perhaps the most important difference between the stock market and the block market is that the stock market has been around longer: about 100 years in the U.S. Although the stock market can be volatile, it’s mature – unlike the world of blockchain, which is still in its hormonal adolescent years.

This is part of the reason why bitcoin and cryptocurrencies have such wild price swings. More risk, more (potential) reward.

…But Blockchains are Kind of Like Businesses

Even though blockchains are not businesses, it’s clear that investors think of them like businesses. Why?

Both businesses and blockchains have a “product” (i.e., a service they provide). Ethereum is a platform for building stuff. Uniswap swaps tokens. Chainlink connects blockchain to the outside world.

Both businesses and blockchains have “customers” (i.e., users). Just as a great business attracts customers, a great blockchain has a large number of users, growing quickly.

Both businesses and blockchains have a “market.” Just like a business may operate in the healthcare or IT market, a blockchain may operate in the financial services or supply chain market.

Both businesses and blockchains have competitors. Some businesses have a sustainable competitive advantage: a “moat” that make it hard for enemies to storm the castle. Some blockchains also have a moat.

Both businesses and blockchains have management teams. For businesses, the team has formal titles (CEO, CFO, etc.). With blockchains, the titles may be looser, but there is still a core team that’s accountable.

Finally, both businesses and blockchains have “market value” (i.e., market cap). For businesses, we use outstanding shares x share price; for blockchains we use outstanding tokens x token price. This market value, at least in theory, more or less reflects the elements above.

Valuing the Ethereum “Business”

Let’s take one of the easiest examples: Ethereum. If we look at Ethereum as a “business,” we might compare it to a technology platform business, like Windows or Android. People build apps on Android; people build dapps on Ethereum.

As I wrote in my article on Blockchain Sector Investing, history shows that technology platforms usually consolidate into one or two big winners. You either have a clear winner (a monopoly, like Google in the search market), or sometimes two big winners (an oligopoly, like Apple and Windows in the OS market).

So, will Ethereum remain the premiere blockchain development platform over time?

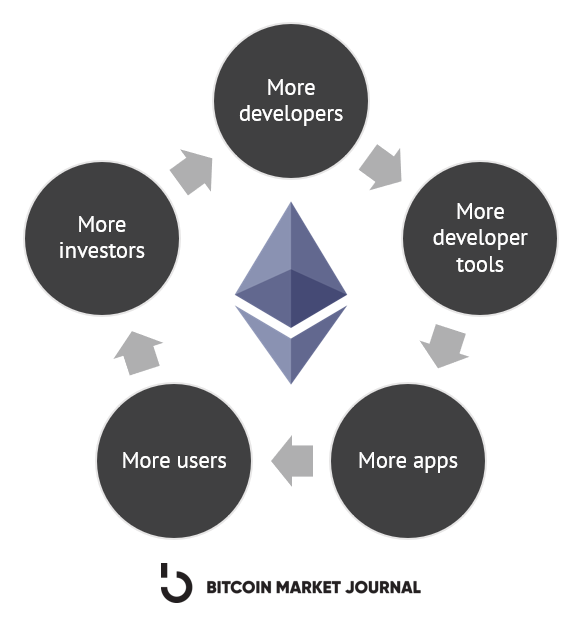

Ethereum has a huge community of developers. More developers leads to more developer tools, which leads to even more developers. More developers leads to more apps. More apps leads to more users. More users attract more money, which attracts more developers, and so on.

It’s a virtuous circle.

Ethereum has an incredibly wide competitive moat, making it hard for anyone else to overtake them in the blockchain development platform market. Even if Amazon developed its own “Ethereum killer” tomorrow, it would be tough to take down Vitalik and his crew of Stoner Cats.

I could go on, but you get the idea. Ethereum is a “business” in the sense of valuing its future prospects, which means (to some degree) that we can even compare it to traditional companies like Microsoft and Amazon.

To do this, we use the idea of comparables, or (if you’re a slick real estate agent) “comps.”

Valuing Blockchains Using Comparables (“Comps”)

Let’s say you’re in the market for a new house, and you’ve found the perfect place in a cute neighborhood: 3 bedrooms, 2 bathrooms, with a state-of-the-art rumpus room. What should you pay?

Most real estate agents will tell you to look at the comparables (“comps”), meaning “Look at similar 3BR-2BA houses in the same neighborhood that have sold recently, and be sure you’re in the same ballpark.”

Valuing by comps is far from perfect (maybe everybody in this neighborhood is overpaying), but often it’s the best we’ve got. So we have to look at comps as a “squishy statistic,” because we’re comparing things that are similar, not identical. (Maybe your comp doesn’t have a rumpus room.)

Back to blockchain: If Ethereum is a platform business, which traditional companies are the comps?

Microsoft (Windows) and Apple (macOS) come to mind, but of course they do much more than operating systems. Alphabet makes the Android platform, but also Google and many other businesses. Even Facebook is a platform business, though of a very different kind.

These are not perfect equivalents, but that’s why we call them “comparables,” not “equivalents.” Let’s look at how they compare:

Again, comparables are by nature squishy, because no two things are exactly alike. (Otherwise they’re the same thing.) The point is not to get a precise price, but to get in the ballpark.

From here, we can apply a common-sense test. If Ethereum was valued MORE than these tech companies, we’d know it was massively overvalued. It Ethereum was valued at, say, a few million dollars, we’d suspect it was massively undervalued (and I’d be buying a heck of a lot more of it).

Using comps, we see the total market value of ETH is about a tenth of these industry heavyweights. When I consider the long-term potential of Ethereum, and the furious pace of innovation I see on the platform today, this valuation seems plausible.

Now let’s change the comps. Let’s say that Ethereum is not in the platform business, but the financial services business. If we look at this set of comps it gets even more plausible:

Market cap is not the only comparable: we can also look at Value Per User to figure out what we’re paying per user, when compared with other network companies like, say, Facebook or Twitter. (More on VPU here.)

We want to do a lot of different comps, just like you’d compare your dream home with a lot of recent home sales. Then we want to combine this quantitative analysis with our qualitative analysis, to find out how good the Ethereum “company” really is. For this, we use our Blockchain Investor Scorecard, which you can download for free.

Value Investing in Blockchain

Ben Graham and Warren Buffett may have invented value investing, but we’re bringing it into the modern age.

By looking at blockchains as “companies,” we can apply the time-tested principles of value investing to bitcoin and cryptocurrencies:

Think like an owner: When you buy a digital asset, imagine buying a company. When you buy ETH, you are a part-owner in Ethereum. Is this a great project with a great product, great financials, and a great management team? Would you buy 100% of Ethereum, if you could?

Analyze rigorously: Use both quantitative (numbers) and qualitative (judgment) analysis to evaluate and compare many blockchain projects, using “comps” to constantly sanity-check them against the stock market. Say “no” to most opportunities, and a big “yes” to a golden few.

Find digital assets on sale: Look for undervalued blockchain projects, or at least try not to overpay. Ideally you’re looking for a terrific project at a fair price (or lower).

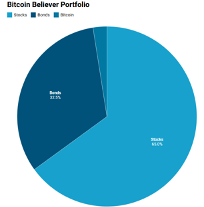

Avoid losses: Diversify your investments, and don’t put all your eggs in one basket. See our Blockchain Believer’s Portfolio for the plug-n-play approach to building a diversified crypto plan.

Think long-term: There are a thousand get-rich-quick schemes in crypto. Ignore them. Instead, focus on building wealth over a lifetime. Don’t think “get rich quick,” but “get rich and make it stick.”

The stock market and the block market will continue to merge over time. Today, it helps to think of them as two versions of the same thing.

Do your homework, find valuable stocks and blocks at a fair price, and invest for the long term. That’s value investing, no matter where you’re investing.

I am a highly experienced writer and editor in the cryptocurrency field. I have written for numerous publications, including CoinDesk and Bitcoin Magazine. I am also the author of two books on cryptocurrency investing. I am passionate about blockchain technology and its potential to change the world, and I firmly believe that cryptocurrencies are here to stay forever.