Bitcoin futures allow experienced traders and investors to bet on the price movement of bitcoin in a regulated format. In this guide, you’ll learn what CME Micro Bitcoin Futures are, how they function, and how to trade them in this guide.

What is a Futures Contract?

Futures contracts originated hundreds of years ago. Farmers would use them to secure the price at harvest time before they planted their crops. If the season went in their favor this minimized their profit, but if the season went against them it minimized their losses.

Let’s look at this example:

Before planting his barley farmer Phil agrees to sell his barley for $500 a tonne to Kate’s Brewery after it’s been harvested. They formalize this agreement in a futures contract. Now, Phil has certainty about the price his barley will sell for, he can plant with the certainty that he won’t sell it at a loss. Kate has certainty about the price she will buy her raw goods for and can plan her brewery’s budget accordingly.

Financial instruments, energy, currencies, and precious metals, can all now be traded by futures contracts. As digital assets mature futures contracts are being created for them.

What Are CME Micro Bitcoin Futures?

Micro bitcoin futures (MBT) are 1/10 the size of one bitcoin or 1/50 the size of the larger five bitcoin futures contract, these smaller-sized contracts offer a new way for traders of all sizes to scale bitcoin exposure with greater precision and add versatility to their trading strategies.

Trading 1/10th of one bitcoin makes this new product more accessible compared to the five bitcoin futures contracts. The maximum order size is 100 contracts. The contracts expire on the last Friday of each month. There are six consecutive monthly contracts to choose from at any given time as well as December this year and December next year.

You don’t need a digital wallet to trade CME MBT because they are financially settled, and therefore, do not involve the exchange of bitcoin. However, you will need to deal with a registered futures broker to gain access to bitcoin futures.

Do CME Micro Bitcoin Futures Belong into Your Digital Asset Portfolio?

Hopefully this guide has helped you decide if CME micro bitcoin futures contracts are something you would like to add to your portfolio. If you choose they aren’t for you, hopefully, you are now better equipped to answer someone else if they ask you about them.

If you’ve been thinking you would like to gain some experience with futures contracts but the size of them has stopped you from doing so CME micro bitcoin futures contracts may be what you have been waiting for.

Just remember that you can always gain more exposure. It can be a costly lesson to learn if a trade goes against you and you are over leveraged.

Does Bitcoin Belong Into Your Digital Asset Portfolio?

Some of the biggest companies, pension funds, college endowment funds, in the world now hold bitcoin on their balance sheets.

But does this mean you should?

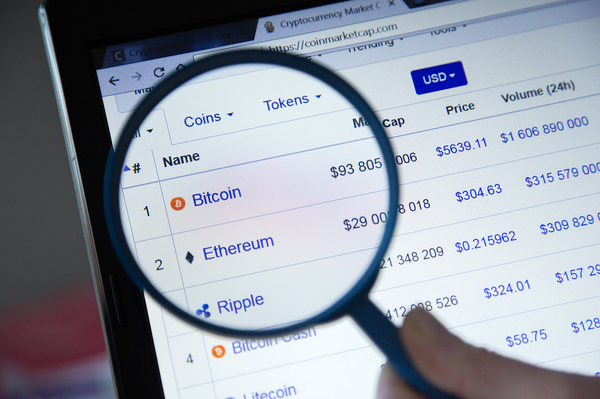

Bitcoin still has the largest market share of any of the digital assets currently available. Though past performance is no guarantee of future performance, its past record of price appreciation is astounding. As user adoption increases and supply coming onto the market decreases, with the scheduled halving’s happening approximately every four years, it’s easy to see the case for possible further price appreciation.

At the end of the day, only you can decide if bitcoin and CME micro bitcoin futures contracts align with your investment thesis.

Related Articles:

If you want to stay up-to-date with the latest trends and developments in the digital asset markets, subscribe to Bitcoin Market Journal newsletter.

I am a highly experienced writer and editor in the cryptocurrency field. I have written for numerous publications, including CoinDesk and Bitcoin Magazine. I am also the author of two books on cryptocurrency investing. I am passionate about blockchain technology and its potential to change the world, and I firmly believe that cryptocurrencies are here to stay forever.